- AI Software

- C3 AI Applications

- C3 AI Applications Overview

- C3 AI Anti-Money Laundering

- C3 AI Cash Management

- C3 AI CRM

- C3 AI Decision Advantage

- C3 AI Demand Forecasting

- C3 AI Energy Management

- C3 AI ESG

- C3 AI Intelligence Analysis

- C3 AI Inventory Optimization

- C3 AI Process Optimization

- C3 AI Production Schedule Optimization

- C3 AI Property Appraisal

- C3 AI Readiness

- C3 AI Reliability

- C3 AI Smart Lending

- C3 AI Sourcing Optimization

- C3 AI Supply Network Risk

- C3 AI Turnaround Optimization

- C3 AI Platform

- C3 Generative AI

- Get Started with a C3 AI Pilot

- Industries

- Customers

- Resources

- Generative AI

- Generative AI for Business

- C3 Generative AI: How Is It Unique?

- Reimagining the Enterprise with AI

- What To Consider When Using Generative AI

- Why Generative AI Is ‘Like the Internet Circa 1996’

- Can Generative AI’s Hallucination Problem be Overcome?

- Transforming Healthcare Operations with Generative AI

- Data Avalanche to Strategic Advantage: Generative AI in Supply Chains

- Supply Chains for a Dangerous World: ‘Flexible, Resilient, Powered by AI’

- LLMs Pose Major Security Risks, Serving As ‘Attack Vectors’

- C3 Generative AI: Getting the Most Out of Enterprise Data

- The Key to Generative AI Adoption: ‘Trusted, Reliable, Safe Answers’

- Generative AI in Healthcare: The Opportunity for Medical Device Manufacturers

- Generative AI in Healthcare: The End of Administrative Burdens for Workers

- Generative AI for the Department of Defense: The Power of Instant Insights

- What is Enterprise AI?

- Machine Learning

- Introduction

- What is Machine Learning?

- Tuning a Machine Learning Model

- Evaluating Model Performance

- Runtimes and Compute Requirements

- Selecting the Right AI/ML Problems

- Best Practices in Prototyping

- Best Practices in Ongoing Operations

- Building a Strong Team

- About the Author

- References

- Download eBook

- All Resources

- C3 AI Live

- Publications

- Customer Viewpoints

- Blog

- Glossary

- Developer Portal

- Generative AI

- News

- Company

- Contact Us

Predict future balance attrition with early warning signals of abnormal withdrawals

Key Capabilities

AI-based balance attrition prediction

AI-based balance attrition prediction

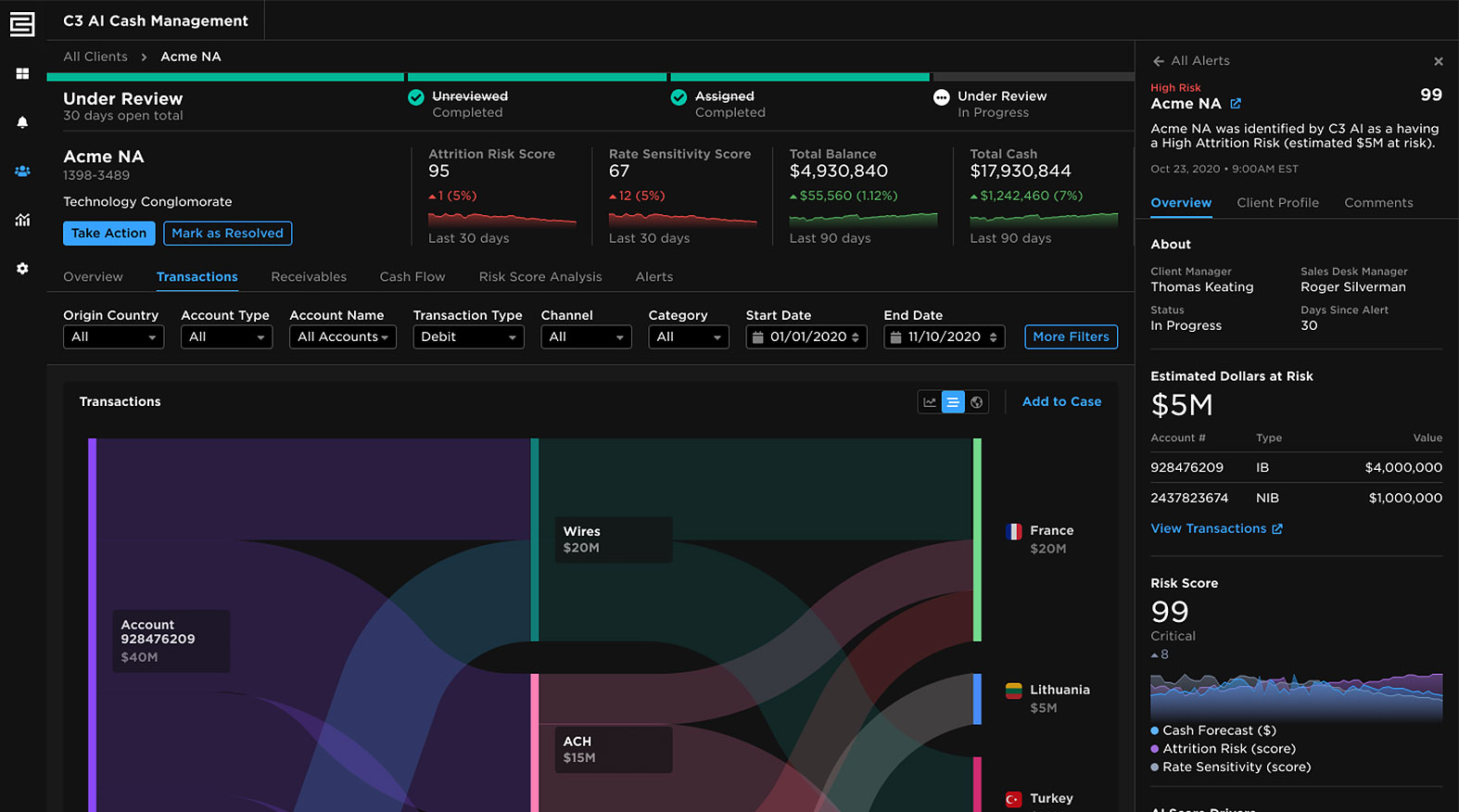

- Prioritize client outreach and intervention using a machine learning-driven risk score that predicts the likelihood of client balance attrition

- Improve the detection of portfolio risk with machine learning models that leverage all available internal and external data

- Provide closed-loop feedback to enable AI models to improve over time and identify new patterns

AI-based early warning signals

AI-based early warning signals

- Detect early warning signals of abnormal client behavior, including balance patterns, payment activity and product usage, in the context of the external market environment

- Analyze interpretable machine learning model output with actionable insights to improve client relationships, satisfaction, and lifetime value

360-degree customer view

360-degree customer view

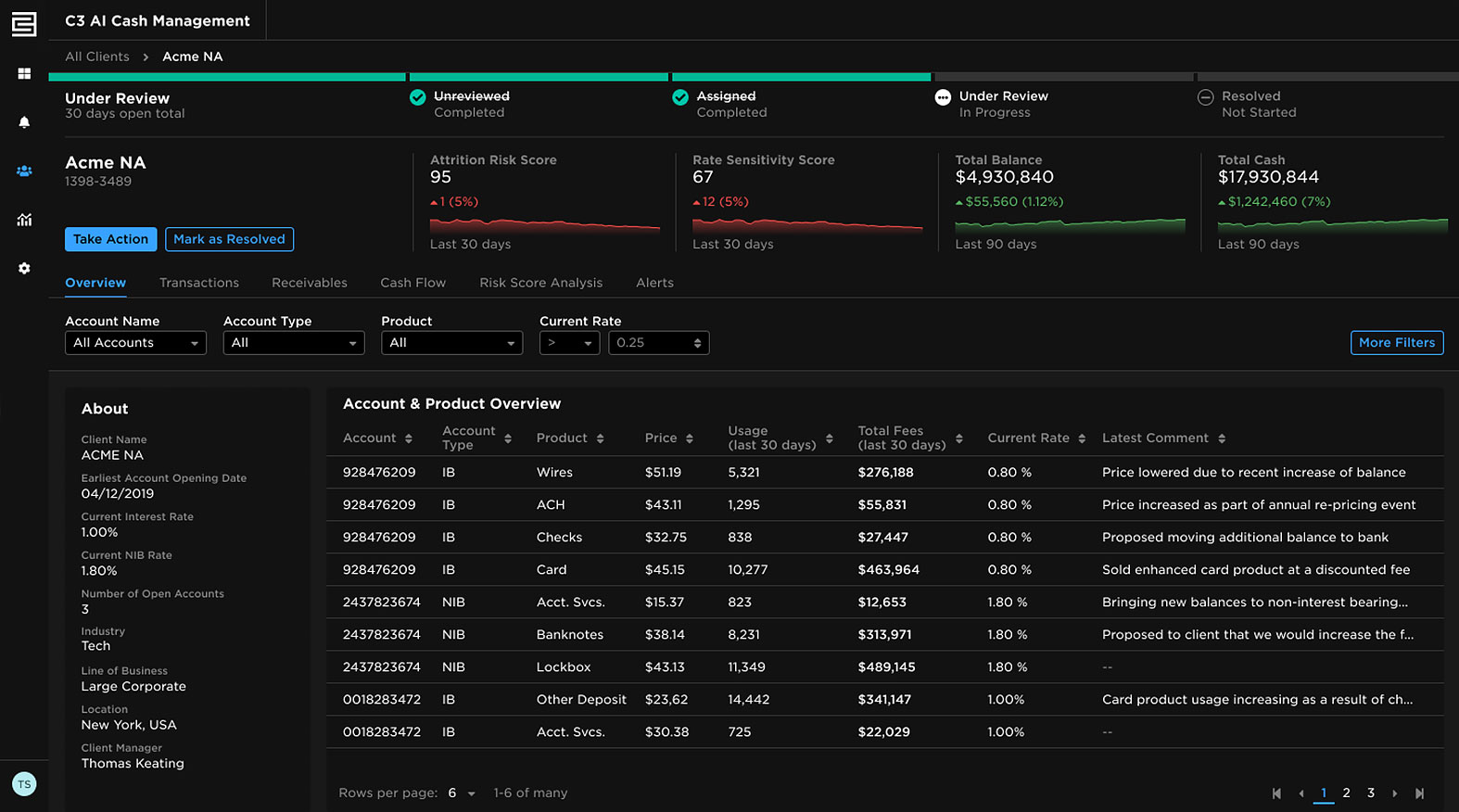

- Unify data from disparate internal and external source systems into a single view of the client’s entire relationship

- Visualize thousands of time-based analytics that model client behavior and expose behavioral patterns

- Observe automatic updates in AI model predictions and changes in behavioral patterns as new data arrive

Balance forecasting and anomaly detection

Balance forecasting and anomaly detection

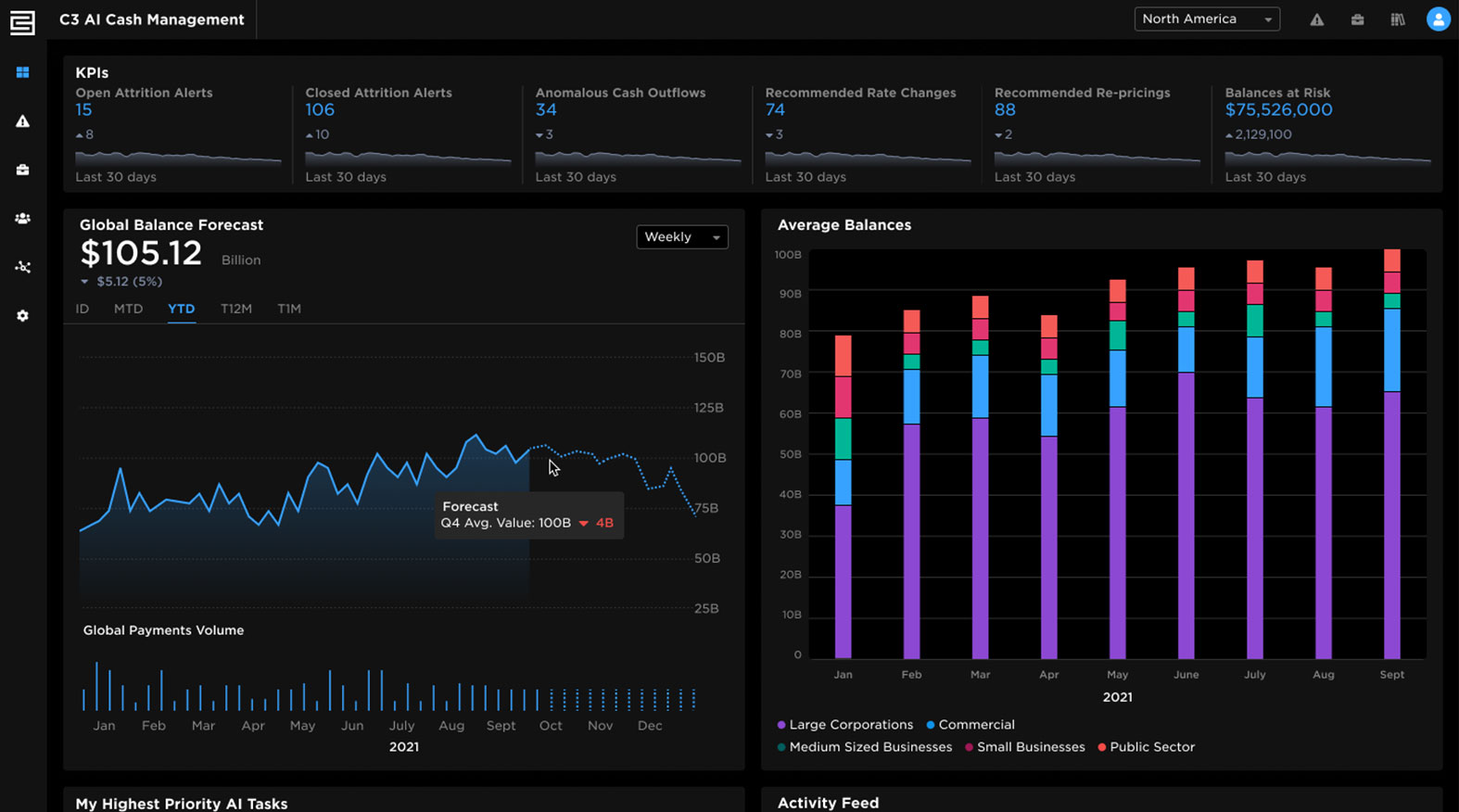

- Review detailed AI-driven forecasts of client account balances over configurable time horizons

- Detect abnormal client behavior, including anomalous balance and transaction changes that deviate from forecasts

Rate sensitivity and price optimization

Rate sensitivity and price optimization

- Predict client sensitivity to rates paid and fees associated with treasury, liquidity, and other payments services

- Create targeted rate and product pricing offers using AI to optimize profitability by client

Explainable AI and interpretability

Explainable AI and Interpretability

- Analyze AI recommendations that guide proactive client intervention

- Leverage easy-to-interpret AI insights to devise targeted cash management strategies

Scope

C3 AI Cash Management benefits treasury and payments teams across a broad range of treasury and liquidity management challenges.

Built For

Corporate Banking

SMB Banking

Retail Banking

Private Wealth Management

Use Cases

Balance attrition prediction

Balance forecasting and anomaly detection

Rate and price sensitivity analyses

Benefits for Application Users

Relationship Managers

Prioritize client intervention activities using AI-based predictions of balance attrition likelihood and identification of anomalous balances using advanced AI forecasting techniques.

Treasury & Liquidity Strategists

Devise targeted rate and pricing strategies in a single interface using AI insights and a 360-degree view of the client.

Treasury & Liquidity Managers

Gain visibility into client account balances, uncover balances at risk by behavioral segments, and direct proactive strategies that reduce portfolio volatility while growing balances.

Data and Architecture